Compounding calculator can be extremely useful in building your personal finances. If you reinvest your gains, you can slowly build up a large amount of wealth even with minimal contributions. If you are saving money for a long-term plan, such as retirement or your child’s education, focusing on compounding can help you reach your goals.

Let’s look at how a compounding calculator can help you visualize this growth and make smarter, more informed investment decisions.

What is compounding?

When money from interest earned on your investments is reinvested, it leads to more interest over additional time. As people keep investing their money, wealth grows at a faster pace. As more time passes for compounding, the base amount (principal) grows and leads to bigger results. You can apply this idea to assets such as savings accounts, bonds, mutual funds, and stocks.

What makes compounding valuable is that it can increase your returns over the long run. For this reason, it is commonly acknowledged that having more time helps you build wealth more easily.

How does a compound interest calculator work?

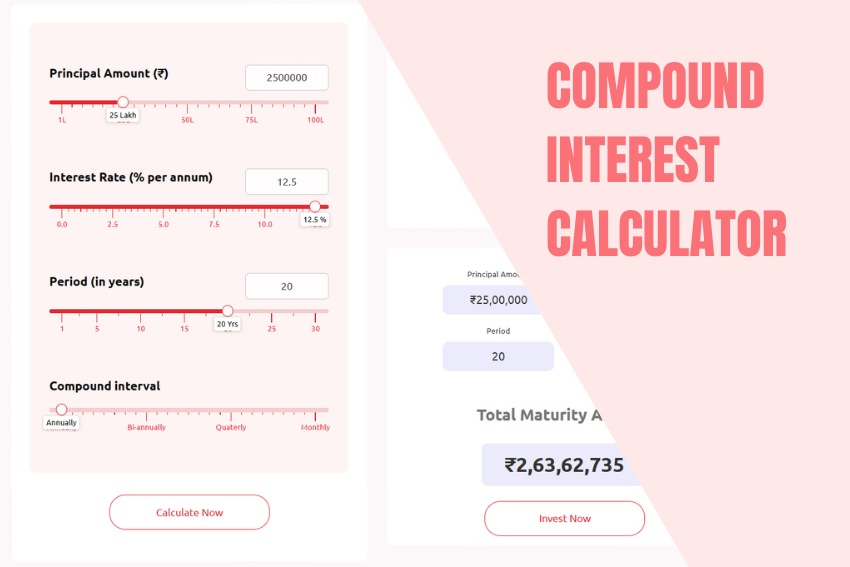

A compound interest calculator is a tool designed to calculate the future value of an investment based on compounding principles. It helps you understand clearly how your investments grow using compound interest. Enter the principal amount, interest rate, compounding frequency, and investment duration to get an expected value for your investment.

I will now describe the process in detail:

- Input the Principal Amount: It is the money you have chosen to start your investment.

- Set the Interest Rate: Put in the amount of interest you’re expecting to earn each year on your investment. The rate might change according to which financial instrument is used and the current state of the market.

- Determine Compounding Frequency: Determine how frequently interest is compounded each year. Common options for how often a contract can be reviewed are annually, semi-annually, quarterly, monthly, or daily. If fund contributions are made more often, the returns will be higher.

- Specify the Investment Duration: Determine how long you plan to let your funds remain in the investment.

- Calculate: The calculator computes your future investment amount using the compound interest formula.

In this case, if you invest $5,000 at a 5% annual interest rate, which compounds each year for 10 years, the future value will be around $8,144.47. It illustrates how your savings will grow as your wealth accumulates through compound interest.

Benefits of a compounding calculator

There are several advantages of a compounding calculator. They are as follows:

- Simplifies Financial Planning: With a compounding calculator, figuring out future investment values becomes easier for anyone planning their money.

- Visualizes Growth: Seeing the expected future return values motivates investors to stick with long-term investments and appreciate how time and compounding work.

- Facilitates Goal Setting: By knowing the potential growth of your investments, you can set sensible targets for your future finances, for instance, building savings for retirement or buying a home.

- Encourages Early Investing: Showing exponential growth influences individuals to invest in the early stages with any amount they have.

- Aids in Decision Making: Once you know how varying interest rates and compounding schedules impact growth, picking an investment becomes much simpler.

Compounding in mutual fund investments

The power of compounding is a crucial factor in the case of mutual fund investments. A lot of people invest in mutual funds because compounding helps their investments grow. With fixed deposits, the interest rate is already set, but mutual funds give returns that change with the performance of the assets. Such income, including dividends, interest, and gains from selling stock, can all be reinvested for additional growth.

Dividends and capital gains earned from mutual funds can be reinvested automatically to buy more units. With this, your investment grows through the profits of the fund and the number of units you receive each time you reinvest. With time, following this process can lead to a bigger return on your investment.

To illustrate, think about a mutual fund giving an 8% return each year. When you invest your dividends and capital gains, your portfolio grows much faster than it would if you just received them as cash. The compounding of interest can result in great wealth over time if you keep your investment for the long run.

Factors That Influence Compounding

There are several variables that can shape how well your investments do:

- Interest Rate: Higher rates help investments gain more with the compounding effect. On the other hand, rates might not be the same, as they can shift depending on economic climate and which investment is chosen.

- Compounding Frequency: Compounding interest more often means the possibility for higher returns. Since interest is applied more regularly, daily compounding usually generates higher returns than annual compounding.

- Investment Duration: Compounding depends greatly on time. The longer your investment lasts, the bigger the compounding effect and the more your wealth will grow.

- Regular Contributions: Practicing regular contributions encourages the mechanical growth in your investments. All contributions are added to the principal, which then grows the amount for calculating interest.

- Tax Implications: If interest earned is taxed each year, it could reduce the power of compounding. Tax-deferred accounts are an example of tax-efficient ways to grow your money.

- Inflation: Inflation reduces the actual value of what you earn. Ensuring your investments provide a gain larger than the rate of inflation will help your money retain and build purchasing power.

- Risk Tolerance: Riskier investments tend to offer better returns. It’s important to take into account both how comfortable you are with risk and how far you want to wait for your investments to mature.

Also Read – Benefits of Using a SIP Calculator

Conclusion

An important factor in wealth creation is the ability of compounding to build wealth slowly but surely. Grasping this idea allows you to achieve much better growth in your investments. Using the compounding calculator helps explain how investing early and reinvesting earnings can really boost your assets.

If you’re just starting with your finances, always remember that early investment, loyalty to your plan, and informed moves can make a big difference. If someone invests in savings accounts, bonds, or mutual funds, the basic principle of compound interest is not changed. Whenever you earn, reinvest the money, give time enough, and see your assets multiply.

Overall, compounding is not only a rule of math, but it also guides us in making smart financial decisions for the future. Thankfully, you can make smarter financial choices that help you build lasting wealth and protection through compounding.