In the ever-evolving landscape of financial services, a transformative movement has taken center stage, not just in one region but globally: it is called open banking. It is a complete game changer that is reshaping the way consumers and businesses interact with their financial data and service providers. By understanding its global implications, it becomes evident that this is not just a fleeting trend, but a fundamental change that has kicked off a new era for the financial sector worldwide.

Understanding Open Banking

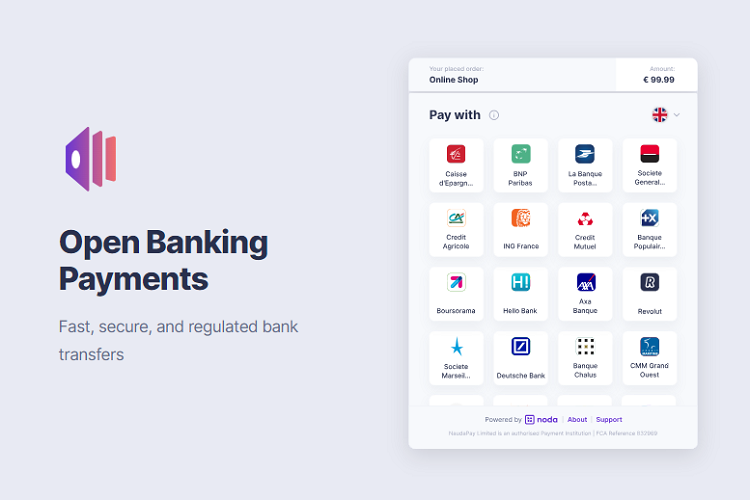

At its core, open banking refers to a system where financial institutions, primarily banks, give third-party providers access to their consumer and transaction data through Application Programming Interfaces (APIs). This is, of course, only done with the explicit consent of the end-users – be they individuals or businesses. The goal is to foster innovation in the financial ecosystem, allowing for the development of new products, services, and solutions that cater to evolving consumer needs.

Global Adoption and Variations of Open Banking

The idea of open banking is taking root in various forms around the world:

- Europe: The European Union has been a frontrunner in instituting open banking through regulatory means. The Second Payment Services Directive (PSD2) requires banks to open up access to their customer data to licensed third-party providers, provided the customer has given consent.

- United Kingdom: Although part of the EU during the inception of PSD2, the UK’s approach to open banking set a distinctive path. The Competition and Markets Authority (CMA) initiated a mandate that required major banks to enable data access to approved third parties, promoting competition and innovation.

- Asia-Pacific: Countries like Australia and Singapore are actively exploring and adopting open banking. Australia’s Consumer Data Right (CDR) empowers consumers with the choice to share their data, starting with the banking sector. Singapore, while not mandating it, encourages open banking through a collaborative approach between banks and fintechs.

- North America: In the US, it is primarily driven by market forces rather than regulation. Financial institutions collaborate with third-party service providers based on bilateral agreements. Canada, on the other hand, is in the exploratory phase, with discussions around establishing a regulatory framework.

- Latin America: Countries like Brazil and Mexico are witnessing regulatory pushes towards open banking. In Brazil, for instance, the Central Bank has established guidelines for sharing data to promote competition and financial inclusion.

The Universal Benefits of Open Banking

Open banking has become increasingly popular in recent years, and for good reason. It is a system of financial services that allows customers to securely share their financial data with third-party providers. This data sharing can provide numerous benefits to both consumers and businesses alike. Here are some of the key advantages of open banking:

Increased Financial Transparency

It enables customers to access detailed information about their finances, such as account balances, transaction histories, credit scores and more. This transparency helps people make better decisions when it comes to managing their money by giving them an accurate picture of where they stand financially at any given time.

Improved Security & Fraud Prevention

By allowing customers to share only specific pieces of information with approved third-party providers, this banking system reduces the risk associated with identity theft or other fraudulent activities because there’s less potential for misuse or abuse by those outside parties who have access only what they need in order complete a requested service/transaction on behalf on the customer.

Easier Access To Credit & Loans

Through this banking systems, lenders can quickly obtain up-to date financial information from potential borrowers which makes it easier for them assess if someone is eligible for certain types loans/credit products without having wait days or weeks while traditional paperwork processes are completed first before making an informed decision whether not approve loan request.

Faster Payments

Payments between banks can be made much faster since all necessary details like bank accounts numbers etc., already stored within secure databases meaning no manual entry required saving everyone valuable time waiting around documents sent back forth before payment finally processed.

While the global approaches might differ, the underlying advantages resonate universally. Enhanced competition, improved transparency, and empowered consumers stand out as some core benefits of open banking. Financial inclusion, a pressing concern in many regions, especially in parts of Africa and Asia, can also be substantially improved. By allowing fintech and other third-party players to access financial data, services can be tailored for segments of the population that were previously underserved or overlooked by traditional financial institutions.

Challenges and Considerations

The global push towards open banking doesn’t come without challenges:

- Data Privacy and Security: The most cited concern is the potential vulnerability of consumers’ financial data. Regulatory standards, like the General Data Protection Regulation (GDPR) in Europe, set the bar high for data protection, but as data moves across borders and systems, ensuring its safety becomes paramount.

- Regulatory Alignment: With each region setting its own regulatory guidelines, there’s a potential challenge for fintechs and other third-party providers that operate globally. Aligning with different standards and ensuring compliance can be resource-intensive.

- Consumer Awareness: In many regions, especially where the concept is only starting to emerge, consumers might not be fully aware of what open banking entails. Education is crucial to ensure that they understand their rights, the potential benefits, and the associated risks.

- Interoperability: With different standards and technologies in play, ensuring seamless interoperability between systems across borders can be challenging.

What’s Coming Next

Open banking is paving the way for a more collaborative, transparent, and innovative global financial ecosystem. As more regions embrace it, whether driven by regulatory mandates or market forces, the world can expect a richer array of financial products and services tailored to specific needs.

This global movement also creates the potential for cross-border financial solutions. Imagine a unified financial app for a frequent traveler, merging banking data from multiple countries, or a global business dashboard pulling real-time financial insights from subsidiaries worldwide.

While the journey towards a fully integrated banking world will undoubtedly have its hurdles, the promise it holds is enormous. The ongoing collaboration between traditional financial institutions, fintech startups, regulators, and other stakeholders is critical in ensuring that the promise of open banking translates into tangible benefits for consumers and businesses alike.

Conclusion

The wave of open banking is sweeping across the globe, marking a new chapter in the story of financial services. Its adoption represents a shift towards a more consumer-centric model where power and choice lie with the end-users. As regions continue to navigate the challenges and explore the potential, one thing is certain: open banking is reshaping the financial landscape, ushering in a new era of innovation, collaboration, and empowerment.