There are many ways to channel your, or your business’s, money. You might consider the stock market or maybe private investments. These options, though they may be rewarding, carry the burden of risk. Similarly, they are still liable in financial crisis.

While searching for a viable means of channeling your wealth, you may consider a Domestic Asset Protection Trust (DAPT). In a journal, Thomas O. Wells states that a DAPT “Provides significant wealth preservation protection.” This means that the wealth you accrue within your trust cannot be violated by creditors. This is also known as a self-settled trust. A DAPT is irrevocable, meaning that it cannot incidentally be altered, terminated, or amended. However, under special circumstances, if specified in the opening, changes can be made. DAPTs are also appealing, as they can possess a wide variety of physical and financial assets.

However, there are many decisions to be made when considering a DAPT, as well as many questions that have to be answered. Important questions, however, are what state should hold your DAPT and what are the best states for DAPTs.

The Top States for DAPTs

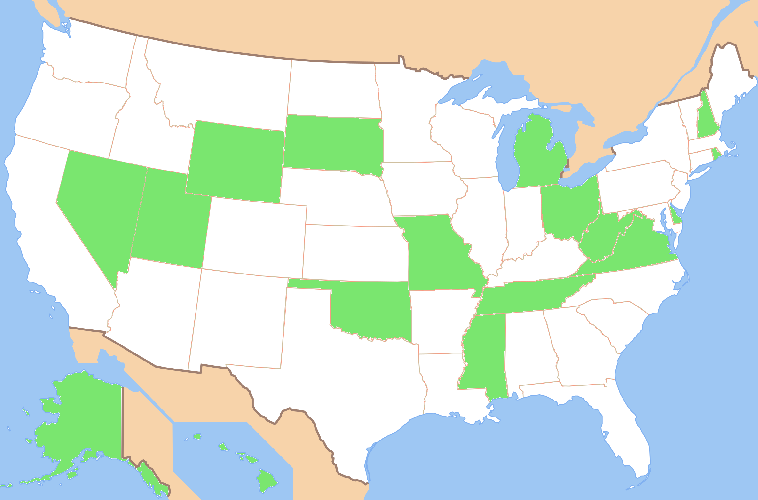

As of 2022, only 17 states allow DAPTs as listed below. Each state has its own set of parameters and waiting times surrounding DAPTs.

| Alaska | Michigan | Nevada | Oklahoma | Tennessee | West Virginia |

| Delaware | Mississippi | New Hampshire | Rhode Island | Utah | Wyoming |

| Hawaii | Missouri | Ohio | South Dakota | Virginia |

Wyoming Trust and LLC Attorney is a resourceful service that provides insight into DAPTs. They argue that the top five states for DAPTs are: Alaska, Delaware, Ohio, Nevada and South Dakota. These states have created the most favorable laws surrounding the creation and preservation of DAPTs.

Which state is the best for DAPTs?

Wyoming Trust and LLC Attorney stipulate that the best state for Domestic Asset Protection Trusts is Nevada. Not only is Nevada one of the first states to inaugurate DAPTs, but it is also the state that is consistently amplifying the law surrounding them.

The Case for Nevada

A significant factor behind Nevada’s attractiveness is its taxation laws. In fact, all the assets you place within a DAPT are protected from income, inheritance, and estate tax. Similarly, Nevada allows you to protect the assets in your DAPT from creditors and lawsuits. This enables you to receive all the financial income from your trust. Moreover, this protection can span generations.

What are the Benefits of a DAPT?

The most cited benefit of a DAPT is its separation from personal liability. This means that your assets are safe from creditors, who may be seeking you to settle your debt. In conjunction with this, those same creditors may feel more inclined to agree or settle with you on how you are going to pay back your debts.

A less known but attractive benefit is the marital separation of assets that DAPTs provide. Much more effective than a prenup, a DAPT can be used to store assets before entering marriage so that in the case of divorce, the assets are safe and undividable.

What are the Disadvantages of a DAPT?

A notable disadvantage of a DAPT is its complicated nature. As a result, it is often better to approach a DAPT with an advisor or legal professional.

Conclusion

There are multiple points of difference between states when it comes to Domestic Asset Protection Trusts. While the top five are Alaska, Delaware, Ohio, Nevada, and South Dakota, it is notable that Nevada is the most favorable. With its generous tax rates and legal parameters, it might be time to consider opening a DAPT.

At the start of your DAPT process, it is important to familiarize yourself with the benefits and disadvantages. It is also vital to grasp the fundamental aspects of the legalities surrounding it. As a result, it could be beneficial to consider consulting with an advisor or financial attorney. Wyoming Trust and LLC Attorney provides informative and insightful resources on forming a DAPT, as well as offering their own services to begin the process.