The Central Government implemented the Goods and Services Tax (GST), and it reformed the previous indirect tax system. Earlier, registered taxpayers had to pay a multitude of taxes at the central and state levels. The states also levied a value-added tax (VAT), the rate of which varied in every state.

GST did away with this complex system and introduced uniform tax slabs for both goods and services. The rules applicable on GST have also made the filing process much simpler for taxpayers through the GSTN portal. However, to file your returns under GST, you need a unique GSTIN number.

But what is a GSTIN number and how can you file GST returns using this number? Read on to find out.

What is GSTIN?

GSTIN stands for Goods and Services Tax Identification Number. Before the implementation of GST, the Central Board of Indirect taxes and Custom (CBIC) provided a unique TIN number to the taxpayer.

In the same way, the CBIC rolled out the GSTIN number for the identification of the taxpayer under GST.

GSTIN Format

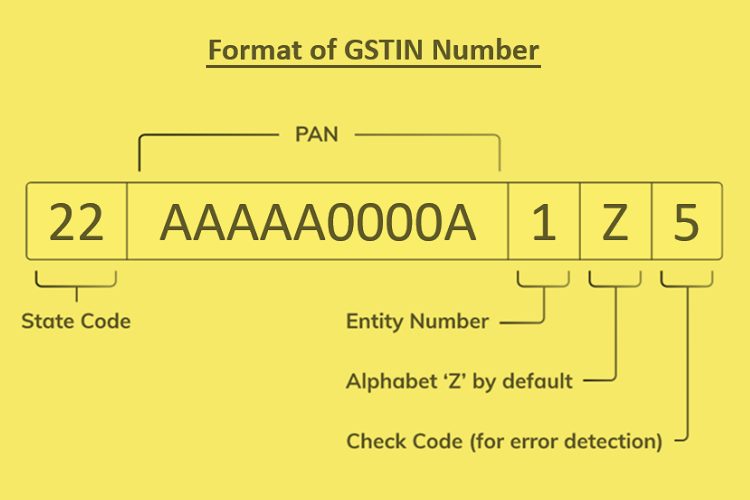

The CBIC provides each taxpayer with a 15-digit GSTIN number that follows the following format:

- The first two digits of the GSTIN number are the codes of the states and Union Territories as per the Census of India 2011

- The next 10 digits represent the Permanent Account Number (PAN) of the taxpayer

- The next, i.e., the thirteenth digit is based on the number of registrations within a state

- The second last digit of all GSTIN numbers is “Z”

- The last digit will be a check code that can be an alphabet or a numerical

How to Apply for a GSTIN?

Once you register your business as a taxpayer on the GSTN portal, you automatically receive a GSTIN number. There is no separate process to apply for a GSTIN. In addition, if you wish to register your business, you can do so using two different methods:

- Online through GSTN Portal

- Offline by visiting a GST Seva Kendra

How to File GST Returns

You can follow two different processes to file returns under GST.

Online Method

- Visit the GSTN portal and log in using your user ID and password

- Enter your 15-digit GSTIN number

- Upload all the invoices that you have

- A reference ID will be attached to all the uploaded invoices

- File the outward return, inward return, and cumulative monthly return

- File the outward supply returns of GSTR-1

- Verify the outward supplies information

- File details of credit or debit notes

- Add details of the inward supplies in GSTR-2

- You can either accept or reject the modifications in inward supplies in form GSTR-1A

Offline Method

To file your returns under GST in offline mode, you will need to visit the nearest GST Seva Kendra for you. You may be required to submit relevant paperwork, and the public servant at the office will process your request.

Different Types of GSTR Forms

There are different types of GSTR that facilitate different types of taxpayers and goods and service categories to file returns. Here is the table showing the types of GSTR forms:

| GSTR Form | Description | Who Should File |

| GSTR-1 | Outward supplies of taxable goods and/or services affected | Every registered person |

| GSTR-2A | Summary return of outward supplies and input tax credit claimed, and tax payment | View-only form |

| GSTR-2B | Date of filing GSTR-1 in the previous assessment period to the current one | View-only form |

| GSTR-3B | Specifics of outward supplies made, input tax credit claimed, tax liability ascertained, and taxes paid | Normal taxpayer |

| GSTR-4 | Specifics about composition taxability | Composition dealer under Section 10 of the CGST Act |

| GSTR-5 | Specifics of outward supplies made, input tax credit claimed, tax liability ascertained, and taxes paid by a foreign service provider | Foreign service provider operating in India |

| GSTR-5A | Summary return for reporting the outward taxable supplies and tax payable by OIDAR provider | Non-resident OIDAR service providers |

| GSTR-6 | Specifics of input tax credit received and distributed by the ISD | Input Service Distributor (ISD) |

| GSTR-7 | Specifics of TDS deducted, refunds, and liability | Taxpayers who need to deduct TDS |

| GSTR-8 | Specifics of all supplies made through the e-commerce platform and the TCS collected | E-commerce businesses |

| GSTR-9 | Specifics of outward and inward supplies and a summary value of supplies reported under every HSN code | Taxpayers under GST |

| GSTR-9C | A self-certified reconciliation statement | Taxpayers under GST |

| GSTR-10 | Final return to be filed three months prior to surrender or cancellation | Taxpayers whose GST registration was cancelled or surrendered |

| GSTR-11 | To get a refund for the goods and services purchased in India by UIN | Foreign diplomatic missions and embassies for refund claims |

Penalty for Late Filing

If you miss the deadline to file your returns under GST, you will have to pay interest as well as a late fee.

- The interest rate payable on late filing is 18% p.a.

- There is a late fee of ₹100 each under CGST and SGST Acts

In conclusion

If you wish to file returns under GST, you will need a GSTIN number. To obtain your GSTIN number, you can register your business as a taxpayer on the GSTN portal. In case you want to register offline, you can visit the nearest GST Seva Kendra.

However, before filing returns under GST, it helps to know all about the different types of forms. This is because each GSTR form is used for a specific purpose. In addition, there are 11 active forms out of a total of 22 forms, which can make it confusing for you to decide which form to file.