The process of refinancing can be a great way to save money on your mortgage, but it can also be a hassle. In particular, waiting for the funds to come through can often be a major pain point.

Fortunately, some companies now offer same-day funding after your application gets approved. This means you can get the money you need to cover medical bills, renovations, and debt consolidation with refinancing without waiting weeks or even months for the funds to come through. Read more about refinancing process and when to refinance your mortgage.

What is the Process of Refinancing?

When you refinance, you replace your current loan with a new one. The new debt terms may differ from the repayment period and interest rates of your existing loan, but the process is generally similar.

You’ll need to go through a credit check and application process, and if approved, you’ll receive the funds from your new loan on the same day. With sites like https://refinansiere.net/refinansiering-på-dagen/, some lenders can provide you with a same-day timeline for your needs. You can also ask a financial advisor and see if this is right for you.

The main reason people refinance is to get a lower interest rate. This can save you money over time and make your monthly payments more manageable. But there are other reasons why you should do the consolidation as well. You should switch from an adjustable-rate mortgage to a fixed-rate so you can plan and allocate a budget each month for the monthly payments, which will be beneficial in the long run.

Whatever your reason, it’s essential to compare the offers available from different financing companies before you decide to take out the new debt. Make sure you understand all the terms and conditions, read the fine print, and ask about fees or closing costs. Once you’ve found the right offer for you, refinancing can be a great way to save money or make your monthly payments more manageable.

How Does Refinancing Work?

1. Assessing your Current Financial Situation

Most banks and lending companies will have a set of requirements and criteria that you need to meet. They will look at your employment history, income, credit score, equity, home value, and other obligations that you might have before approving your application.

It’s best to assess these areas and know your eligibility. If you have a solid income and a spotless credit history, then you may be qualified with interest rates that are better than what you currently have. However, if this has gone down since the first mortgage application, then you might be better off staying with your current situation.

2. Shop Around for Deals

It’s best if you’ve been given a pre-approval process via multiple financing companies so you can compare terms and interest rates. This is going to provide you with the best deals that are available in the market. You can make wiser choices by comparing many offers and determining your next moves.

3. Calculate the Figures

After selecting the best offers, it’s best to know about hidden fees, origination costs, and other additional expenses. Calculate your expenses and savings and see if this is worth it. Learn more about the costs when you click this site.

As an example, the refinancing might cost around $5,000 upfront. However, the new monthly dues will save you $100 or less than what you originally paid. It will take approximately fifty months before it will all be worth it. However, if you plan to move out in the future, there might be better times to do this. Also, there are early payment fees that can cause issues if you’re going to finish before the expected date.

What are the Benefits of Refinancing Your Mortgage?

When you refinance, you may receive extra funds that you can use for many purposes. This can be a great option if you need money for an emergency expense or to make a large purchase.

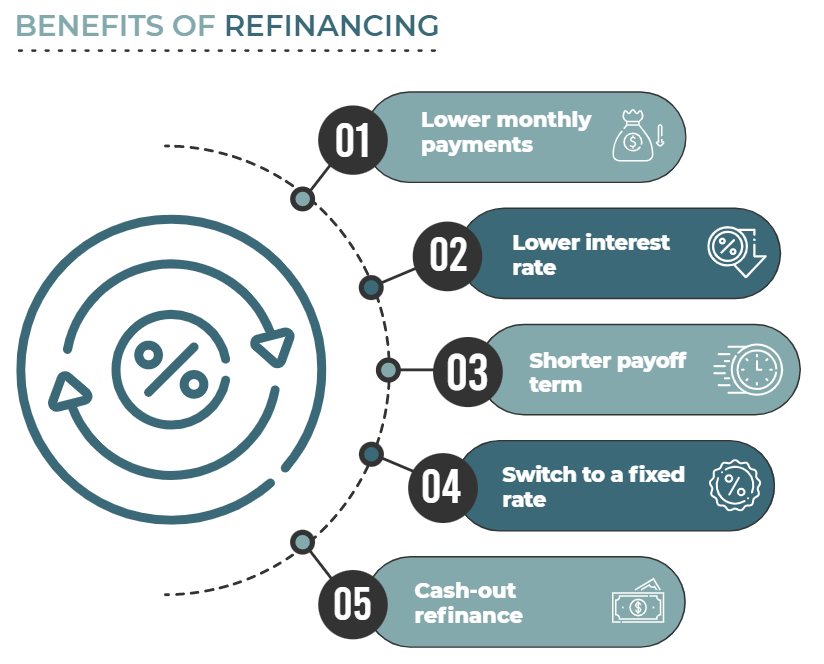

There are several other benefits of refinancing, as well. For example, you can get a lower interest rate on your new debt, saving you money over time. You may also be able to extend the repayment term, which gives you more time to plan ahead.

How to Start?

If you’re looking to refinance your mortgage, there are a few things you need to know. The process can be confusing and time-consuming, but we’ve covered you. Here’s everything you need to know about refinancing your mortgage from start to finish.

The first thing you need to do is gather all of the necessary documentation. This includes your current mortgage statement, proof of income, and bank statements. You’ll also need a good credit score; most lenders require a score of 620 or higher.

Once you have all of your documentation in order, it’s time to start shopping around for lenders. Compare rates and terms from several different financiers before making a decision. Once you’ve found the right bank, it’s time to fill out an application.

The lender will then review your information and decide whether to approve your loan. If approved, you’ll receive the funds within a few days, typically on the same day you apply. And that’s it! You’ve successfully refinance your mortgage.

When to Refinance Your Mortgage

The most common reason people refinance their mortgage is to save money on interest costs. It may be worth refinancing if you can get a lower interest rate than what you’re currently paying. You’ll also want to consider the fees associated with refinancing, which can add up.

Another reason people refinance their mortgage is to shorten the loan term. This can save you money in the long run, as you’ll pay less interest over the life of the loan. Of course, you’ll need to have enough equity built up in your home to qualify for a shorter loan term.

Some people refinance their mortgage to get cash out on the same day as their equity. This can be used for home improvements, debt consolidation, or other expenses. Just be aware that this will increase your monthly payments and the overall cost of your loan.