Obtaining a personal loan serves as a solid financial plan to get quick money that supports medical needs and building houses while enabling debt consolidation of expensive debts. Every borrower needs to grasp the fundamental steps in borrowing funds and how to handle them thoughtfully. A simple interest calculator serves as an important tool to help you create better plans.

In this article, we’ll break down the personal loan procedure while demonstrating how simple interest calculator helps you in conducting better financial choices.

What is a Personal Loan?

Getting a personal loan happens without requiring you to provide assets as security because this type of loan remains unsecured. Personal loans get approved through evaluations of your payment ability along with your income and credit score evaluation. A personal loan allows users to draw funds for paying credit card debts while funding wedding expenses and medical requirements.

A personal loan stands out because it gives borrowers maximum scheduling control. The loan provides broad financial versatility because you can apply it to any personal expense without restriction whereas specific loans require particular uses (i.e. home or car loans).

How Does a Personal Loan Work?

The loan process starts from loan applications that require you to present financial data to your lender. The lender performs evaluations on your financial history together with your income amount and credit score to decide on loan approval. The approved funds arrive in your account after which you start paying back the loan through scheduled monthly EMIs (Equated Monthly Installments). The percentage used to calculate the loan interest stays constant throughout the repayment period.

These three elements determine the amount you pay each month in your loan:

- Loan amount: The loan payment totals the full amount you obtain from the financial institution.

- Interest rate: The cost of interest exists at the ratio the lender sets.

- Loan tenure: The period in which you must pay back the loan makes up the loan tenure.

Understanding Simple Interest on a Personal Loan

The method calculates only the principal loan amount for simple interest whereas compound interest applies to both principal and accumulated interest. Every payment directed to your borrowed funds goes straight to interest since you are required to pay interest only on the initial loan amount.

For example, if you take a personal loan of Rs. 1,00,000 with an interest rate of 12% per annum for 2 years, the simple interest would be:

Simple Interest = Principal x Rate x Time / 100

So, for this loan:

Interest = Rs. 1,00,000 x 12% x 2 / 100 = Rs. 24,000

The total amount to be repaid over the loan tenure would be Rs. 1,00,000 (Principal) + Rs. 24,000 (Interest) = Rs. 1,24,000.

Knowing this helps you understand how much interest you will pay over the loan’s duration.

How a Simple Interest Calculator Can Help You

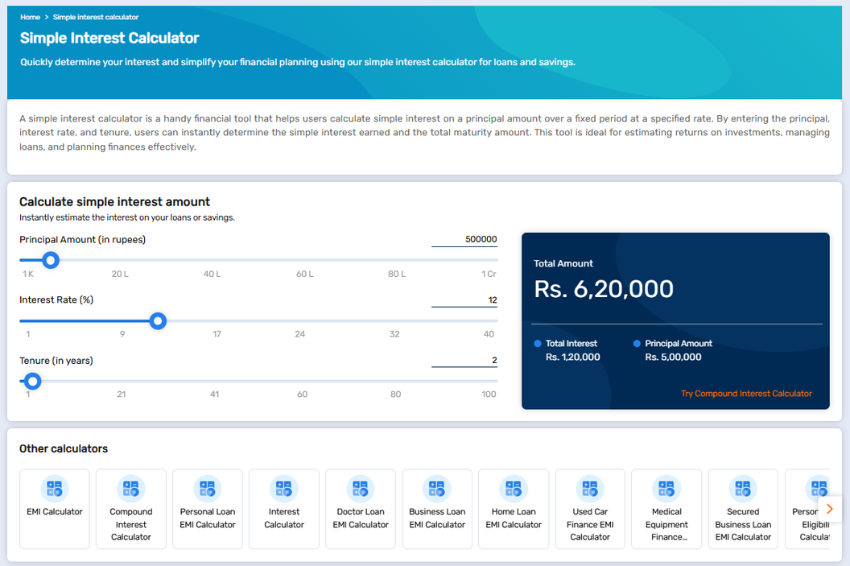

A personal loan repayment requires the simple interest calculator to prepare the most effective strategy for debt management. The calculator enables users to find both the complete interest cost along with monthly EMI from the data entry of principal amount and interest rate over the chosen loan period.

With the help of a simple interest calculator, you will get the following advantages:

- Estimate your total repayment: The simple interest calculator enables you to predict the entire loan repayment you will make during the tenure which covers both your principal and interest costs. The calculated information allows you to understand your financial commitment fully before committing to a loan contract.

- Understand monthly payments: Through input of loan amount combined with interest rate along with tenure duration the calculator displays monthly EMI. Understanding the loan amount in advance enables you to check if the payments align with your regular financial commitments.

- Compare different loan scenarios: The simple interest calculator helps users review multiple loan opportunities by allowing them to assess different loan quantities combined with term lengths. The calculator enables variable adjustments which display changes in your monthly payments and your total interest expense.

- Avoid surprises: The worst experience occurs when the monthly payment amount comes as a surprise to you. Using this tool at the start of the borrowing process lets you understand your financial responsibilities so you stay financially secure throughout time.

- Helps you make informed decisions: A simple interest calculator enables you to select a loan with minimum repayment expenses between available choices or most suitable EMIs. The tool enables you to find the best option that suits your monetary needs.

Example of How the Simple Interest Calculator Works

Let’s say you want to borrow Rs. 2,00,000 for 3 years at an interest rate of 10% per annum. Using the simple interest formula:

Interest = Rs. 2,00,000 x 10% x 3 / 100 = Rs. 60,000

Total repayment amount = Rs. 2,00,000 (Principal) + Rs. 60,000 (Interest) = Rs. 2,60,000

Using an EMI calculator, you can further break down how much you would need to pay monthly. The EMI would be Rs. 7,222 (approximately) for the entire loan tenure, including both principal and interest.

Key Benefits of Using a Simple Interest Calculator

- Easy to use: Using these calculators proves simple and fast because they maintain user-friendly operations. You give simple details such as loan amount and duration along with interest rate through the calculator to get an instant output.

- Helps with financial planning: The tool allows better financial planning because it reveals your precise monthly repayment amount which prevents you from spending beyond your budget limits.

- Informed loan decision: The calculator enables you to determine different loan options for making educated decisions about your financial capacities and objectives.

Conclusion

Learning about the personal loan repayment schedule stands as the essential step before applying for this type of funding since it prevents unexpected difficulties. Simple interest calculator enables you to design your financial strategy better which enables you to select favorable loan conditions while maintaining control of your monthly payment obligations.

Perspective borrowing of personal loans enables you to achieve your financial objectives using them correctly. After understanding interest mechanics and life-impact of loan repayments you should make your decision. A simple interest calculator brings you closer to taking an educated financial decision with responsibility.